The recently announced proposal of implementing a 50-year mortgage product had tongues wagging last week. There were countless articles, posts and news stories that jumped on the story. There was lots of debate about whether this type of product would be a smart choice in the long term, even though it provides a lower monthly payment. It is not a mystery that the biggest challenge in the real estate market is affordability, and that finding a way to lower monthly payments could help.

Bear in mind that this is speculative at this point, and would require policy changes that would take a year or more to complete if it is decided that this product will be brought forward. And of course, a trusted mortgage professional will provide the best insights; I have a curated list if you would like one. However, I thought it was important to discuss this as it relates to the affordability challenges we are facing in today’s real estate market. In addition, I see it as an opportunity to provide alternative solutions and highlight the benefits of homeownership. So here goes.

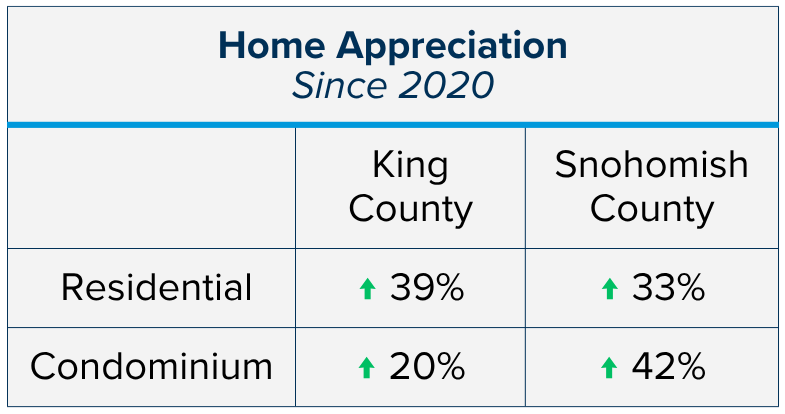

The median price for a single-family residential home in King County has increased by 39% since October 2020 and by 20% for condos. In Snohomish County, the median price for a single-family residential home has increased by 33% since October 2020 and by 42% for condos. This, coupled with higher interest rates, has caused monthly payments to jump up, sidelining some buyers.

For example, the median home price for a single-family residential home in Snohomish County in October 2020 was $570,000, and the interest rate for a 30-year fixed conventional loan was 3%, equaling a monthly principal and interest (P & I) payment of $1,922.51 based on a 20% down payment. Currently, the median home price in Snohomish County for a single-family residential home in October 2025 was $755,000, and the current rate for a 30-year fixed conventional loan is 6.25%, equaling a monthly P & I payment of $3,718.93 based on a 20% down payment. This comparison illustrates that monthly P & I payments have increased by 93% since 2020, almost double.

The good news is rates are down 1.66% from the 7.91% peak in October 2023 and down .75% from 7% since May of this year. That, along with decelerated price appreciation, has improved affordability, making now a better time than we have seen in the last two years to buy. The biggest obstacle is putting the historically low rates of the past that are not likely to return in the rearview mirror, and find other solutions to make a purchase. Perspective is key.

The 3-4% climb in rates since the pandemic heyday did not accompany a spiral in home prices. While median home prices peaked in mid-2022 as rates reached 5.5%, prices did correct but then moderated and stabilized. Year-to-date in 2025, prices have been unusually flat year-over-year in Snohomish County and up 1.4% in King County. It appears that home prices are holding and that any decrease in interest rate will only help maintain values and likely cause them to increase.

In fact, over long historical periods, many sources cite about 3% to 5% per year average appreciation nationwide. One estimate puts a long-term average appreciation at about 4.27% per year (1967-2024) nationally. More recently, over the past 5–10 years, some data shows average annual growth closer to 7%-9% due to especially strong market gains.

So, how would a 50-year mortgage help? Adding 20 more years of term to a loan will naturally lower the payment, but it increases interest payments and equity grows slower. Let’s use this example to help understand how it all pans out.

Let’s take a $750,000 home, with a 10% down payment and a conservative annual appreciation rate of 3%. Then apply an interest rate for a 30-year fixed at 6.25% and for a 50-year fixed at 6.5%. It is important to note that a longer mortgage term typically requires a higher interest rate. The 30-year product will result in a monthly P & I payment of $4,156, and the 50-year product will result in a monthly P & I payment of $3,805, a savings of $351 per month.

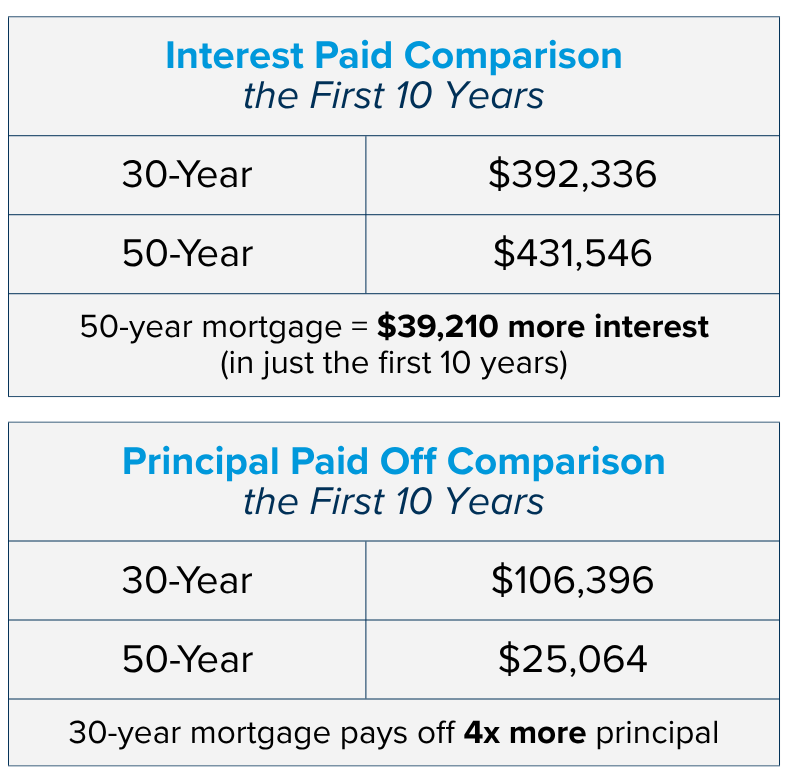

While lowering the monthly payment can be helpful to qualify for a higher loan amount and/or reduce monthly overhead, a borrower needs to consider their wealth-building strategy. In the first 10 years of the loan on a 30-year term, the borrower will pay $392,336 in interest and pay off $106,396 in principal; a total of $498,732 paid. On a 50-year term, the borrower will pay $431,546 in interest and pay off only $25,064 in principal; a total of $456,610.

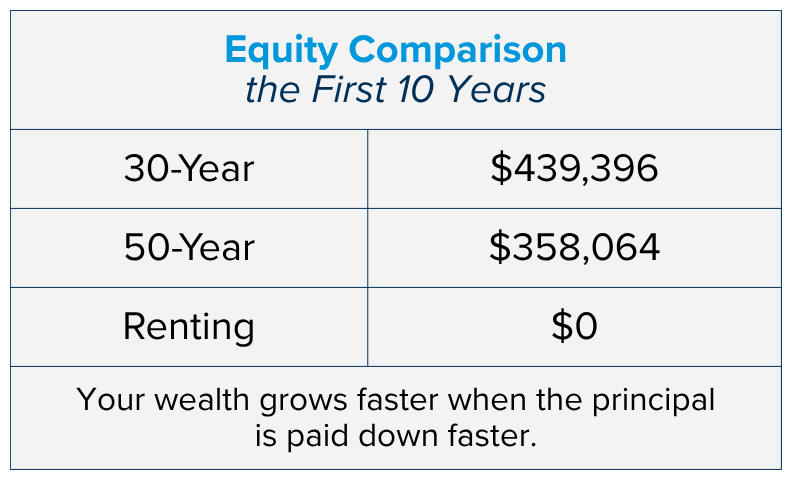

Based on 3% annual price appreciation over those 10 years, the home’s value would be $1,008,000. The 30-year term borrower would have $439,396 in equity, and the 50-year term borrower would have $358,064 in equity, a $81,332 difference. Both options build more wealth vs. renting, which highlights the benefits of homeownership as one of the most powerful wealth building tools.

So, who should consider this option and who should not? And when I say consider, it doesn’t mean recommend – it means knowing your options. If this option were to show up in the future, most borrowers will review all their choices and then decide which product best suits their goals. Note, for many, waiting to qualify for a 30-year term may be a better choice given their circumstances and long-term plans.

Things to Consider With a 50-Year Mortgage

It can create a different balance between affordability and long-term cost. Here are some points to think about when deciding whether it might fit your situation:

Monthly Payment Flexibility

A longer loan term can reduce monthly payments, which may make a home feel more manageable from a month-to-month budget perspective. This can be helpful for buyers who want or need lower payments early on.

High-Cost Markets

In very expensive areas, stretching the term may make purchasing a home more attainable. It can be one way to navigate markets where prices rise faster than incomes.

Cash Flow Priorities

Some buyers prefer to keep monthly costs as low as possible so they can direct money toward:

- Investments

- Savings

- Renovations

- Other financial goals

A 50-year mortgage may support that flexibility.

Long-Term Plans for the Home

If you expect to stay in the home for a long time, the slower pace of equity building may feel acceptable in exchange for a lower monthly obligation.

Age & Income Trajectory

Younger buyers with many decades of earning ahead—or buyers anticipating future income growth—may feel comfortable taking on a longer-term loan with the idea of refinancing, selling, or paying extra over time. Although if you are able to pay extra, a 30-year loan makes more sense.

Other Factors to Keep in Mind

While there can be advantages, there are also trade-offs worth weighing:

- Total interest costs will be significantly higher over the life of the loan.

- Equity builds more slowly, which may matter if you plan to sell or refinance soon.

- It may not fit well for buyers nearing retirement or those who want a rapid payoff timeline.

A 50-year mortgage can be one tool to improve affordability or cash flow, but it’s helpful to consider how the lower monthly payments align with your long-term financial goals, timeline, and comfort with the slower accumulation of equity.

Other options that can improve buyer affordability besides a 50-year term include some house hacking tricks. And the good news is these can be used now, given that the 50-year term is only a speculative, albeit one that got a lot of attention.

Some house hacking tricks that can help offset monthly payments include: buying a duplex or a triplex and living in one of the units and renting the other(s); buying with the plan to have a roommate(s) who will pay rent and offset your monthly payment; or buying with a trusted partner and sharing the monthly payment while you build equity together. In my next newsletter, during the week of Dec 8th, I will expand on these house hacking options, plus some others, and share some success stories.

Until then, the most important thing to understand is that owning real estate builds wealth faster than renting, but how long you plan to stay in the house and your loan term matters for the long-term equity picture. That is why it is important to consult with a trusted real estate professional and a skilled lender to help you organize and execute a winning, solvent plan.

As always, it is my goal to help educate and shed light on all of your options, so you are empowered to make strong decisions. If you or someone you know is curious about how today’s market trends align with your housing goals, please reach out.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link